Samuel Alito Was Foolish To Sell His Bud Light Stock

The conservative culture war boycott against Bud Light was actually a great time to buy stock in a successful company, even if you don't like Bud Light.

Supreme Court Justice Samuel Alito reportedly sold thousands of dollars of stock in brewing giant Anheuser-Busch InBev while the company was embroiled in a culture war controversy last summer.

That was a foolish decision.

No, not because the timing of the sale suggests that Alito was participating in a politically motivated campaign against Bud Light, trying to signal his opposition to transgender rights, or any of the other artificially constructed narratives that are central to the media coverage of Alito's stock sale, which was first reported by the Substack Law Dork. And, no, not because there's any moral or ethical significance to Alito's decision (or anyone's) to buy or sell stock in a certain company. There isn't.

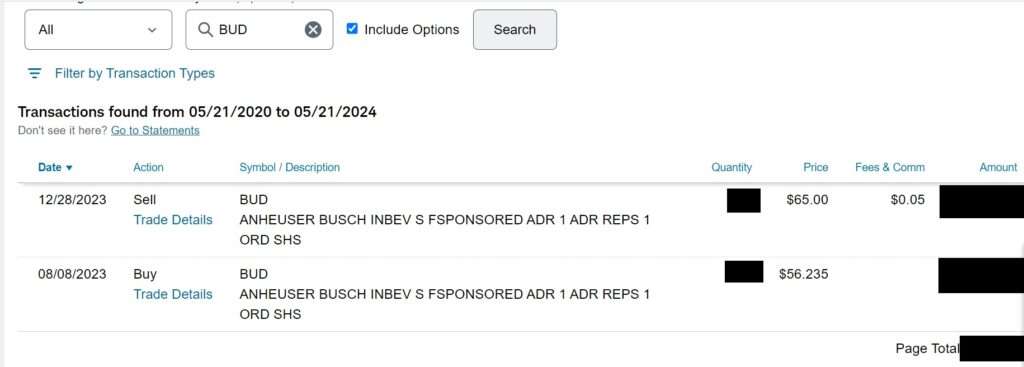

The only thing we can say for sure about Alito's decision to sell up to $15,000 in Anheuser-Busch InBev stock last summer is that it cost him money. That's why it was a bad decision. At the end of the day on August 14, when Alito reportedly sold the stock, BUD was trading at $56.35. Today, each share of the same stock is worth over $66.

I hope Alito got a thrill from sending that backhanded message to InBev's bosses (if that was his intent) because the opportunity cost was likely a few hundred bucks.

Voting with your wallet is a legitimate and valuable thing to do, of course. I'm a bit more skeptical about the idea of voting with your stock portfolio, however, because selling shares means giving up your rights as a shareholder and your ability to influence the company's direction. A sales boycott seems likely to be more effective than an attempt at tanking a stock price, which only creates an opportunity for others to scoop up good stocks at lower-than-usual prices. The market is a lot more robust than keyboard warriors on both right and left would like you to believe.

Case in point: When conservatives started boycotting Bud Light and Inbev's stock price fell, I bought it. I didn't do that because I care about Bud Light (it's a bad beer that I generally avoid buying and drinking) or Mulvaney or because I wanted to signal some artificial political point.

I did it because I wanted to make money. Anheuser-Busch InBev is a massive, successful company. The boycott seemed like a temporary setback that would pass as soon as the conservative culture warriors—who generally do not have an impressively long attention span—got outraged at something else. Buy the dip, as the saying goes, and I did.

Sure enough, Bud Light didn't vanish from American culture—though the fact that Mexican import Modelo has recently surpassed it as the most popular beer in the United States is an interesting cultural story. (It surely helps that Modelo has more taste.)

Neither did Bud Light's parent company, which keeps chugging along as one of the world's largest, most successful producers of alcoholic drinks. And when I owned a small share of the Anheuser-Busch InBev's stock, the company's success was also mine—even if I never bought a single case of Bud Light. Capitalism is great like that.

(Full disclosure: I sold those shares of BUD in December when the stock's price hit $65 per share, equal to where the stock had been trading in the days before the too-online conservatives got upset about the Mulvaney ad.)

Maybe Alito sold his BUD stock to register a complaint against the company's marketing strategy. Maybe the trade was executed automatically because Alito had set a "stop" order to sell the BUD stock if its price fell below a certain level. Regardless, as National Review details, there's nothing about the sale that seems to run afoul of judicial ethics rules.

Does this fact tell us anything about Alito's character or competence as a judge, as some are suggesting? Of course not. But I would advise against letting him manage your 401(k), seeing how he sold that BUD stock at just about the worst possible time—the stock has traded well above the $56 mark for most of the past decade.

That's all that matters in this case. The stock market exists so we can all benefit from the wealth generated by successful businesses. Allowing the culture war to get in the way of that goal is a shame—and potentially a costly one. Let's not do that.

Show Comments (102)